Why your clients want to hear from you—not CNN—and how relational email builds trust that lasts

Key Takeaways

- Most firms underestimate how much trust is lost (or gained) between tax seasons.

- Your clients want clarity from you—not commentary from the news cycle.

- Relational email strengthens retention because it answers real questions at the right time.

- Consistent communication builds loyalty, referrals, and pricing power.

Most firm owners think of marketing as a way to bring in new business.

And yes, acquisition matters.

But the biggest growth opportunity for your accounting or tax practice is sitting right in front of you already: your existing clients.

After April, your internal monologue might sound like:

“We made it. Time to breathe.”

Meanwhile, your clients are thinking something very different:

“I’m still confused… I still need help… I wish someone would tell me what to do next.”

They’re overwhelmed. Unsure what to believe. And they don’t understand half of what they’re hearing on CNN, Fox, TikTok, or YouTube.

Whether they say it out loud or not, they’re looking for a trusted guide.

That someone needs to be you.

Your Most Underrated Retention Strategy: Relational Email Marketing

Marketing between tax seasons often feels optional.

But this is actually when clients decide whether they trust you enough to stay, upgrade, or refer.

Relational email marketing fills that gap with something simple and deeply effective: A steady, human voice in the moments that matter.

It turns trust into loyalty… and loyalty into long-term value.

When you show up year-round with clarity and empathy, you’re not just serving clients better. You’re also earning the ability to raise prices with confidence and to upsell naturally.

Clients who hear from you regularly become referral engines without being asked.

Why This Matters for Retention

A true accounting firm retention strategy isn’t built through systems alone. It’s built through connection.

Your clients stay with you because they feel seen. They feel informed. They feel safe.

And those feelings aren’t created through annual communication.

They’re created through steady, relational touchpoints that remind them, “I have someone in my corner.”

This is especially important in a financial landscape full of noise and misinformation.

Your clients don’t need more noise. They need a trusted interpreter.

And that’s at the heart of relational email.

Timely Communication Builds Trust

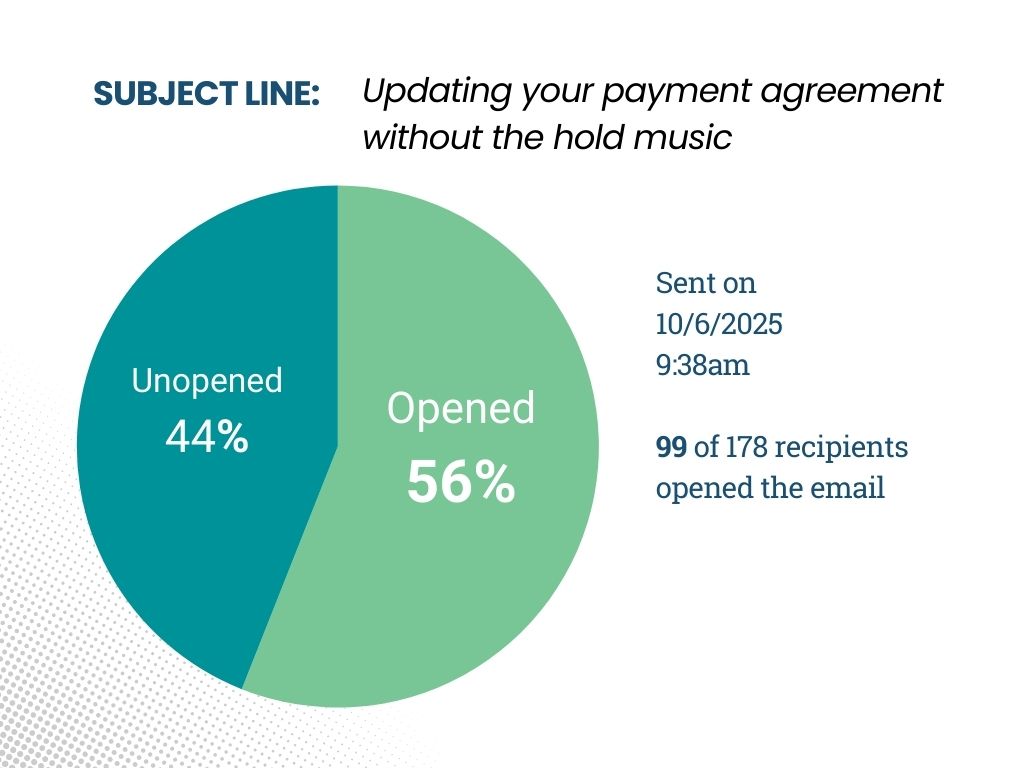

A quick look at your real-world open-rate proof

A few weeks ago, when the “no taxes on tips” provision in the OBBBA legislation became news, we sent an email about it on behalf of our clients.

Across all firms, across all lists, the average open rate was:

57%!

That is stronger than the industry average (typically 35-40%).

This is what happens when the right message meets the right moment.

People want guidance from the person their accountant because they trust you to guide them.

And they open your emails because the information is timely, relevant, and calming.

What Should You Email Clients About?

Here are topics your clients will always care about and that naturally position you as their steady guide:

Timely events

- Tax legislation updates

- IRS changes

- Financial news that affects their everyday and long-term lives

Everyday financial guidance

- Estimated tax payment reminders

- Filing guidance through different deadlines

- Deduction opportunities they should be making moves to take advantage of now

- What they need to watch out for with the IRS

- Ideal bookkeeping moves

- Cash flow insights

Thoughtful perspective

- How to think clearly in uncertain financial moments

- How to interpret confusing news cycles

- How to plan ahead

Personal connection

- What you’re seeing in your firm

- Trends you’re watching

- What clients should prepare for next

Clients don’t need long essays. They need short, clear, human notes like a trusted advisor tapping them on the shoulder with, “Here’s what matters this week.”

How Relational Email Strengthens Retention, Pricing Power, and Referrals

A regular rhythm of communication quietly reinforces the relationship in ways clients feel, even if they can’t articulate why. Communication means…

You stay top-of-mind without forcing it.

You educate instead of reacting.

You shape the narrative.

You build permission for pricing.

You reduce churn by calming anxiety.

This is what retention looks like in practice.

One Perspective on the power of Email Marketing

Hearing another firm owner describe what consistent communication has done for their practice reinforces the point in a way no explanation alone can.

You may not have time to write thoughtful, timely emails every week.

Most firm owners don’t.

But we do.

So if you want to take this part of your retention strategy seriously. If you want to stay in front of your clients and keep earning trust all year long… we’d be glad to help you make it happen.

FAQ

“How often should an accounting firm email its clients?”

Weekly works well for most firms because it keeps you present without overwhelming your audience. But the real goal is consistency. Clients want to know you’re paying attention to the things that affect them — and a steady rhythm of communication builds that trust over time.

“Will clients unsubscribe if I email more often?”

A few will, and that’s normal. The people who remain are the ones who value your guidance. What matters most is sending emails that are timely, helpful, and easy to understand. When the content is relevant, clients appreciate hearing from you.

“What kinds of topics should accountants write about?”

Start with what your clients are already wondering about — IRS changes, legislation, seasonal reminders, or common issues you’re seeing. Short, clear guidance goes a long way. You don’t need long essays; you just need to help people make sense of what’s happening.

“Does relational email actually help with retention?”

Yes. Clients stay with the advisor who helps them feel informed and supported throughout the year. Regular communication builds that confidence in a way once-a-year contact simply can’t.